Q&A Regarding FY 2016 Earmark Repurposing

The purpose of these questions and answers is to provide technical advice to the Federal Highway Administration's (FHWA) division offices and State departments of transportation (State DOTs) on matters associated with the repurposing of earmarked funding for Federal-aid projects pursuant to section 125 of the Department of Transportation Appropriations Act, 2016 (Pub. L. No. 114-113, Division L, Title I) (hereinafter "provision").

What is the purpose of this provision?

The purpose of the provision is to make funding available from earmarks and designated projects that have not been advanced by State DOTs. The limitations in the provision are to ensure the projects are obligated promptly and used in the same geographic area as the original earmark to provide funding for other needed projects eligible under the Surface Transportation Block Grant Program (STBG) (23 U.S.C. §133(b)), or the Territorial and Puerto Rico Highway Program (THP) (23 U.S.C. §165).

Do earmarks have to be repurposed?

No. If an earmark is not repurposed, then it will remain unchanged and available for obligation.

Does the list of earmarks and allocated funds prepared by the FHWA’s Office of the Chief Financial Officer (OCFO) identify the only earmarks and allocated funds that can be considered for repurposing?

No. The list may not include all the earmarks and funding programs that may be eligible under the provision. However, it will give States a summation of the projects that could be considered. States should work with their FHWA division offices to ensure all earmarks and allocated funds listed or otherwise identified meet the repurposing eligibility criteria and the amount of funds is available. If a State identifies an earmark that is not listed, they should provide the name, the original amount, and the legislation for the earmark. The funds must be allocated in FMIS before the repurposing process can take place.

How long are the funds and obligation authority available for obligation?

From the date a repurposing request is submitted by the State, funds may be obligated up to 3 years after the fiscal year of the request. Therefore, obligations for requests received in FY 2016 must be obligated by September 30, 2019. Unobligated balances will lapse on that date but the properly obligated contract authority funds will remain available for expenditure. 23 U.S.C. 118(c)(2) will apply to contract authority from the Highway Trust Fund. Any General Funds (Budget Authority) will be cancelled 5 years after the funds expire.

Is obligation limitation associated with repurposed funds subject to August Redistribution?

No. While some obligation limitation may be subject to August Redistribution prior to repurposing, such as the limitation for allocated programs, once funds are repurposed they are no longer subject to August Redistribution.

Do all earmark repurposing requests have to be submitted this Federal Fiscal Year?

Yes. States may submit a request to repurpose earmarks at any time prior to September 12, 2016. Any earmarks not repurposed will remain unchanged with the same original period of availability.

If Congress changed the description of an earmark at any point prior to this provision, can it still be repurposed?

Yes. The repurposing should be based on the latest project description, including applicable earmarks for which the original description was subsequently revised by Congress.

If an earmark is repurposed under this provision, can it be changed again?

No. Once repurposed under this provision, the project description no longer meets the requirement of the provision that the project be described in applicable legislation or a report identified by Congress and, as such, cannot be further repurposed after September 12, 2016.

Can the repurposed funds be used to replace previously obligated funds on an existing project?

No. Pursuant to 23 CFR 630.110(a), properly obligated funds may not be replaced. A State may use repurposed funds to add additional funds to a project due to a need for additional obligations or to convert advance construction as long as that project is identified at the time the repurposing is originally requested.

What does the requirement that the project be within the same geographic area and within 50 miles of the earmark mean?

The repurposed funds may be obligated only on a new or existing project within 50 miles of the original earmark designation in the State. Fifty miles can be considered from any reasonable point from the location of the earmark; but the new or existing project must remain within the State.

Who has the authority to request repurposing of an earmark that appears to be for a local agency?

The provision provides the authority for a State to repurpose any earmark that was designated on or before September 30, 2005 “located within the boundary of the State or territory”. The only requirement for the State is that the repurposed project must be within 50 miles of the designation, within the State, and eligible for STBG.

What is the basis for the requirement that applicable earmarks be designated before October 1, 2005?

The provision states an earmark must be “more than 10 fiscal years prior to the fiscal year in which this Act becomes effective.” The Act became effective in FY 2016. As such, 10 years before FY 2016 is FY 2006, which began on October 1, 2005. More than 10 years, therefore, is before October 1, 2005.

Can discretionary awards made by the Secretary without Congressional identification be repurposed?

No. If the project was not identified by Congress in applicable legislation or report and the Secretary used full discretion to select projects in a discretionary program, the funds may not be repurposed under this provision.

If a repurposed project is completed, can excess funds due to cost underruns deobligated from the project be re-obligated on another project?

If a repurposed project is completed and excess funds are deobligated, the unobligated funds may be used only on another project from the same earmark identified on the modified transfer request form submitted before September 12, 2016. In addition, for contract authority funding after the period of availability, the reobligation must occur in the same fiscal year as the deobligation. Moreover, the original obligation must have been proper (an amount was not obligated in excess of the estimate to complete the project authorized or before the project was ready to proceed), and the deobligation must have been for a valid reason complying with 23 CFR 630.110(a).

Can the repurposed funds be transferred to another agency or Federal Lands to carry out a project or projects?

Yes, based upon authorized transfer procedures as described in FHWA Order 4551.1.

Can earmarked funds that were transferred to another agency be repurposed under this provision?

No. The provision applies only to funds being administered by FHWA.

Are earmarks that are not subject to obligation limitation required to use annual formula limitation after repurposing?

No. Only funds that are subject to obligation limitation and do not have obligation limitation remaining available will need to use annual formula obligation limitation.

If earmarked funds were deobligated after December 18, 2015, can the project be qualified for the “less than 10%” provision without further justification?

No. The provision provides a specific cut-off date for the 10% requirement, which is the effective date of the provision, December 18, 2015. The earmark still must be treated as 10% obligated. Earmarks that are obligated 10% or more as of the effective date of the act must be closed in FMIS and final vouchered before they can be considered for repurposing. All of the funds deobligated from the closed project(s) for the earmark may be considered for repurposing. Project closure may occur at any time before the deadline for repurposing earmarks.

Can funds deobligated after December 18, 2015, also be repurposed?

Yes. But if the obligation amount exceeded 10% on December 18, 2015, the earmark project(s) must still be final vouchered and closed in FMIS.

What does “have been closed and for which payments have been made under a final voucher” really mean for earmarks that are 10% or more obligated?

A closed project means closed in FMIS. If the project is not a FMIS project, the State must certify the project is closed. Final voucher paid means the State has requested final payment from FHWA based on final project estimates. The State should consider if additional funding is needed to make the started earmark project functional before it considers repurposing the remaining earmark funds. All projects related to the earmark must have a final voucher and be closed for the funds to be eligible to be repurposed.

How detailed does the new project description on the repurpose request need to be?

The project description should clearly define the scope of work and the project location that the funds will be obligated on before the end of the availability period. Please see the OCFO memo titled “Project Funds Management Guide for State Grants” dated October 29, 2014, for additional information. The project description does not need to specify the phase of work, i.e., P.E., right-of-way, or construction.

Can the State choose an “area wide” project, such as a guardrail replacement program project in a specific city or county?

Yes; however, to ensure the integrity of the earmark and use of funds, the “area wide” project must be limited to work within the 50-mile area of the original earmark, and the project description must be clearly defined and eligible under FHWA project authorization guidance. For example, the State may not repurpose an earmark for an unidentified list of resurface projects in the 50-mile area.

If the earmark was for ‘Highway xx in an identified city,’ is the 50-mile range from anywhere in the city?

No. The 50-mile radius is from any point on the specified highway or work location in the identified city.

Does preliminary engineering or right-of-way payback apply to the original earmark?

If the earmark, as written, was specifically for preliminary engineering (PE) (e.g., design activities) or right-of-way acquisition, then consistent with the FHWA PE Order, the project is not subject to PE or right-of-way reimbursement to FHWA because the earmark had a specific limited purpose. If the State did use part of earmarked funds for PE or right-of-way activities that were intended to include construction prior to repurposing and the amount obligated was less than 10% of the earmark, the earmark may be repurposed but the expended funds for PE or right-of-way activities will be subject the applicable reimbursement provisions. If the State spent 10% or more of the earmark intended for construction for PE or right-of-way activities, the project cannot be considered complete. If the State promptly pays back those activities, the funds could be considered for repurposing.

How can the State determine how much obligation limitation is available for the earmark?

If the funds have not been allocated in FMIS, the relevant program office should be able to provide that information. If the funds have been allocated, first go to the “Fund Control Menu” in FMIS and look up the applicable program code. See the “Limitation Type” column. Then go back to the “Fund control” menu, select “Limitation – Balances”. Select the appropriate limit type and determine if the limit is “Limit by Demo”.

If a portion of the funds for an earmark was previously transferred to another agency, can the remaining balance retained by FHWA be used for repurposing?

Yes. The State must certify that the project is closed and may repurpose the remaining balance that is administered by FHWA. Stated differently, if funds were previously transferred to another agency, only funds returned to FHWA (currently administered by FHWA) can be repurposed under this provision.

Why are there negative unobligated balances on the FMIS N25A report for some earmarks (or Demo IDs)?

Some Demo contract authority was permitted to be used on other demos for various reasons, including advance funding authority under the High Priory Projects program. If your State has a Demo with a negative unobligated balance, you must identify which Demo was used to balance the funds. A State cannot transfer funds if the funds were used under a different Demo even if the balance appears on the N25A as unobligated.

Does FHWA have to approve the project selected for repurposing?

No. The Division Administrator’s approval represents the FHWA’s concurrence on eligibility of each earmark requested for repurposing and the identified project is qualified. The FHWA divisions are to work with States to ensure the provision’s requirements are met for repurposing, such as: if an eligible earmark has less than 10% of the funds obligated or the State demonstrated that it was complete; and, if the repurposed project is for an eligible activity within 50 miles of the original location and is in the same State as the original earmark.

What are the requirements to obligate funds repurposed under this provision?

Standard Federal-aid requirements will apply for obligation. The obligation of the funds must be for the project identified during repurposing. Please see the OCFO memo titled “Project Funds Management Guide for State Grants” dated October 29, 2014, for additional information.

Can the Division Administrator delegate approval of these requests?

The Division Administrator can delegate the approval only to the Assistant Division Administrator. The Division Administrator’s signature is required to ensure the appropriate level of and multi-discipline review has been completed. The Division Administrator’s approval of a State’s repurposing request constitutes FHWA’s concurrence that (1) the repurposed earmark request meets the criteria for repurposing, and (2) any new proposed projects are STBG (or THP) eligible, within 50 miles of the earmark description, and within the State.

Can States request an extension beyond September 12, 2016, to submit earmark repurposing requests?

No. Extensions cannot be considered beyond September 12, 2016. For requests to be processed before the end of the fiscal year and to be considered valid for processing, FHWA division offices must submit repurposing requests to the OCFO’s “FHWA Transfers” e-mail address by September 12, 2016. To ensure repurposed funds are available for obligation before the end of the fiscal year, the request must be submitted by August 29, 2016.

What is the purpose of the earmark certification box?

The certification statements for both the State DOTs and the FHWA Division Administrator are to provide clearly defined and consistently applied assurance that the requested repurposing meets the eligibility criteria set forth in the provision.

Does the State have to use the transfer form to request repurposing?

Yes. This form was slightly modified for the earmark repurposing requests and to ensure the necessary information is provided for the OCFO to efficiently complete the repurposing process and meet the requirements of the provision.

Will the State have to do any quarterly reporting?

Yes. States must submit quarterly reports as required by the law proving the authority. However, FHWA will facilitate these reports by providing the States a consolidated report each quarter containing the project identified and approved for repurposing. The State will provide the FHWA division office a letter certifying the accuracy of the list. The reports are required only from States that made a request to repurpose earmarks.

Why are some of the demo ID’s repeated on the earmark lists?

Some demo ID have multiple program codes and were identified from more than one law so it the report filter created more than one line for the demo. Please refer to the FMIS N25A report for details on the correct program code and the amount of funding available for each program code.

Is there a limited time period to expend obligations?

For funds from the Highway Trust Fund (i.e., contract authority), the obligated funds are available until expended; but the project can become inactive if it is not proceeding. For funds from the General Fund (i.e., budget authority), the funds will be cancelled 5 years after the period of availability, September 30, 2024, and will no longer be available for expenditure.

Can the repurposed funds be used to convert advance construction (AC)?

Yes. As long as the project was properly identified during the repurposing process the funds may be used to convert AC.

Can “placeholder” or “backup” projects be identified during repurposing process?

No. The actual projects the State plans to obligate funds on must be identified with the amount of repurposed funds to be obligated on that project. Token amounts of funding for a project will not be considered.

The State should identify the amount they intend to obligate to each project, understanding that some adjustments might occur due to estimates. For example, if the earmark has $300,000 available and the State identifies 3 projects they intend to obligate $100,000 on each, the intent is that each project should get $100,000, with minor adjustments for estimates. They should not distribute the funds to multiple projects and then, for example, obligate all the funding on one of them. Also see questions #49 to #51. (Revised 4/20/2016)

Does the Federal-aid number need to be identified at the time of repurposing?

No, the Federal-aid number can be identified later at the time of obligation.

Does the FMIS N25A report show if the earmark was from an eligible public law? (Added 4/20/2016)

Yes, Public laws are identified on the N25A report. For an earmark to be eligible it must be in a law or a Congressional report for a law passed before the end of FY2005, i.e., Public Law (Pub. L.) 109-83 or lower. Earmarks in Pub. L. 109-115, 110-008, and higher are not eligible.

Do any Federal-aid requirements have to be met before the funds can be repurposed to the new project, including being on the STIP? (Added 4/20/2016)

No. Federal-aid requirements need to be addressed before obligation; but not before the earmark funds are approved for repurposing. The only requirement is identifying the eligible project(s) for use of the earmark funds.

Earmark funds are obligated on two different Federal-aid project agreements, each for 5% of the earmark amount. Do both project agreements have to be closed to repurpose the balance? (Added 4/20/2016)

Yes. If the total amount obligated from the earmark meets or exceeds the 10% limit, then all projects must be final vouchered and closed.

Some earmarks are missing from the published list on FHWA’s website compared to the lists we obtained from other sources. Where are those projects? (Added 4/20/2016)

A few earmarks were allocated under two different program codes, specifically SAFETEA-LU HPP earmarks. In some instances, one program code was obligated more than 10% and the other program code was not. If the earmark, in total, has obligations 10% or greater, then it is not eligible unless the FMIS project agreement(s) has been final vouchered and closed. Such instances will not be on the FHWA published list of projects less than 10% obligated. Also, some of the lists were generated well in advance of December 18, 2015, and funds may have been obligated on some earmarks beyond the less than 10% threshold, causing them to not appear on the list. Please review the FMIS N25A report to ensure the earmark meets the less than 10% obligated requirement. The projects may be on the list of earmarks obligated greater than 10%.

Do earmarks that are final vouchered and closed have to have been authorized before FY 2006? (Added 4/20/2016)

Yes. All earmarks must have been authorized in legislation before FY 2006 to be considered for repurposing.

We are confused by the repurposing of obligation limitation. Can you explain the various types of obligation limitation that could be affected? (Added 4/20/2016)

-

Earmarks have various types of limitation. The State's funds and limitation balances on the W10A report may change category after repurposing of an earmark. Following are descriptions of the different limitation types:

- Special limitation for specific earmarks at the program level

-

All earmarks from the same program draw its limitation from the associated limitation pool. The limitation pool amounts may match the allocated funds at 100% or less. Examples of special limitation at the program level include: Transportation Improvements (program code LY30); TEA-21 High Priority Projects (program code Q920); and Projects of Regional and National Significance (program code LY40). To repurpose an earmark which has program level pool limitation:

-

Determine the limitation type from the Program Code Crosswalk. See column "PC Type Description (limitation type)".

-

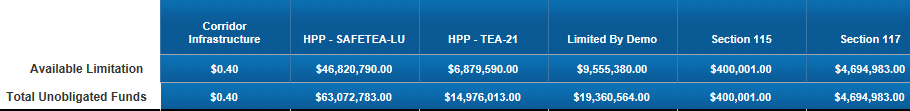

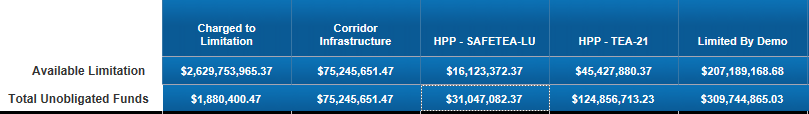

Refresh the Business Objects report "Lim buckets by Demo ID" to get the total amount of contract authority contrasted to the total amount of limitation which are available for the program. See example below.

-

If the total Available Limitation is equal to Total Unobligated Funds, then the total unobligated balance of the Demo ID would be repurposed to the program code shown on the crosswalk in column (-B-).

-

If Available Limitation is less than the Total Unobligated Funds, then the State would repurpose the earmark fund balance using the program codes shown on the crosswalk in columns (-B-) and (-C-) depending upon the amount of available limitation the State determines to use for the repurposed earmark funds. However, the remaining total limitation balance for the program cannot exceed the remaining total unobligated balance of funds for all earmarks in the associated program.

-

-

-

Special limitation authorized only for a specific earmark within a program

-

High Priority Projects authorized in SAFETEA-LU section 1602 #1-3676 have limitation assigned to each earmark (e.g., by Demo ID). The limitation type is Limited by Demo.

To repurpose one of the earmarks from this program:

-

Look up the amount of available limitation for the specific Demo ID from the FMIS Fund Control Limitation Balances screen. Filter for your State and Limited by Demo. Then expand Details and open View Limit by Demo ID.

-

Lookup the available limitation for both program codes HY10 and LY10. These amounts must be repurposed to program code RPS9.

-

The excess contract authority (funds which have no matching obligation authority) must be repurposed to program code RPF9.

-

-

-

Earmarks which draw from annual limitation

-

Refer to the Program Code Crosswalk and the Business Objects "Lim Buckets by Demo ID" report to identify by Demo ID or program code which earmarks (or programs) draw from Charged to Limitation balances.

-

b) When earmarks with discretionary limitation are repurposed from the State's existing allocated funds, the State may see a change in their Charged to Limitation account balance. This limitation was previously allocated to the State for these funds. When funds are repurposed to RPS9, then the applicable amount of limitation will be moved from the "FUNDS SUBJ TO ANNUAL OBLIG LIM" section of the W10A "TOTAL ANNUAL OBLIG LIM" to the special limitation category "TOTAL SPECIAL LIM".

-

-

Exempt from limitation and non-Federal-aid limitation

-

For program codes shown on the crosswalk as Exempt and Non-Federal-aid in the PC Type column, use the program codes shown on the crosswalk – RPE9 and RN#9. The State's limitation balances will not change.

-

The fund amounts on the W10A report will continue to be shown in the Exempt category and the Other category, as appropriate.

-

RPF9 note: Funds repurposed to program code RPF9 will draw from the State's formula limitation balance at the time that the funds are obligated. If the funds are not obligated and lapse, the limitation will not be affected.

RPS9 note: Special limitation for funds repurposed to program code RPS9 will expire at the end of fiscal year 2019.

All repurposed funds will show unobligated balances as "Possible Lapse Fiscal Year End" 2019 column when visible on the W10A report (in FY 2017).

If an earmark was revised during the 2012 repurposing activity for specific 2003 to 2006 earmarks carried out by the Secretary, can the earmark be repurposed under this action? (Added 4/20/2016)No. The description of the earmark has been changed by that action and is no longer as “identified” in applicable legislation.

Can toll credits be used with the repurposed funds? (Added 4/20/2016)If the earmark was previously eligible to use toll credits as non-Federal share, then the repurposed funds may also use toll credits as the non-Federal share.

If an earmark is described as “Statewide” or “anywhere in the State” in the authorizing legislation, how does the 50 mile rule apply? (Added 4/20/2016Because the earmark is already authorized to be used anywhere in the State, the 50 mile rule has no application. The repurposed funds are only limited for use within the State for which the funds were earmarked.

How specific should the amount be for the project identified to receive the repurposed funds? (Added 4/20/2016)The amount should be a realistic amount the State intends to obligate for the project based upon the current project cost estimate. “Token” amounts may not be identified with the intent to provide options for the earmark funding use. See Question 38.

If the project estimate is more than was anticipated when the repurpose form was submitted, can a State DOT obligate more funds to a repurposed earmark project from other projects identified on the repurpose transfer form? (Added 4/20/2016)Question #38 specifies that the amount and projects identified on the transfer form need to be specific. Thus, only minor modifications should be made between identified projects on a transfer form. The State should use other funding sources if the final estimate significantly exceeds the funds identified for a project rather than significantly redistributing earmark funds identified for another project.

What is the difference between Contract Authority (CA) and Obligation Limitation (or authority)? How does it impact the ability to obligate these repurposed funds? (Added 4/20/2016)Contract authority (CA) (also referred to as the “funds”) is the actual amount of funding authorized to be used for a purpose by Congress in the applicable legislation and may be obligated in advance of appropriations. Contract authority is typically provided in multi-year laws. To limit the CA from multi-year legislation into the annual budget and appropriations process, Congress establishes a maximum amount of the contract authority that can be obligated in each fiscal year in an appropriation act. This is referred to as obligation authority (OA) or obligation limitation (used interchangeably in FHWA). The States receive annual OA typically from formula distributions and with certain allocated program funds. Special OA may be provided for an extended period, such as the fiscal year plus three years or may be provided as “available until expended.” The amount of OA is typically less than the CA. For this reason, many of the earmarks have more CA available than OA. In this case, the State must use annual formula OA for any excess CA if they wish to obligate the balance exceeding the OA originally provided for the earmark. Annual formula OA will not be impacted when the funds are repurposed. The annual formula OA will only be impacted in the FY the funds are obligated.

Finally, some CA is provided as “exempt” from limitation and is not subject to any limitation when obligated.

It should be noted, most Federal funds, other than those from the Highway Trust Fund, are provided as budget authority (BA). BA typically does not require additional OA to be obligated because it is limited directly by the appropriations which made it available. BA is typically one year or available until expended.

If the earmark has more funds (contract authority (CA)) than obligation authority (OA) and the State does not wish to use formula OA of the repurposed funds, do they have to repurpose the full amount available for the earmark? (Added 4/20/2016) - Special limitation for specific earmarks at the program level

-

Yes, the State must repurpose the full amount of CA even if they do not plan to use formula OA to obligate the excess CA. This is an acceptable variance from Question #38 to take into account the excess CA.

The State wants to transfer repurposed funds to another agency, e.g., FTA. Do we have to submit two transfer forms? (Added 7/19/2016)Yes, it will be necessary to submit both the FHWA-1575 (ERP) to repurpose the earmark to the new purpose and submit the FHWA-1576 to transfer the funds to the other agency. Both forms may be submitted at the same time if the receiving agency will obligate in the current fiscal year. The FHWA-1576 will show the repurposed funds program code.

To whom should the State send the certification letter and what does it need to include? (added 7/19/2016)The State or territory should send the certification letter to the Division Administrator. The letter should state that the funds from the earmark projects shown in the attachment [which we provided] will be obligated only for the respective projects which are eligible in accordance with the repurposing provision (Section 125 of the Department of Transportation Appropriations Act, 2016 (Pub. L. No. 114-113, Division L, Title I). The letter may address any corrections that are consistent with and does not change the original request as submitted on the transfer form. Please ensure the list of projects is attached to the letter.